Building talent in wealth management is a long-haul process, which perhaps comes naturally to a man who competes in ironman endurance races.

Brian Mora, senior vice president of experienced advisor recruiting, Ameriprise, spoke to this publication recently about the way this US firm recruits and develops talent; he also shed light on approaches advisors take to marketing their own business.

At a time of multi-trillion-dollar wealth transfer, market turbulence and the rising complexity of managing wealth, talent management is at the forefront.

As far as Mora is concerned, advisors won’t make the jump to a new firm if they don’t think they’ll get the support and chance to build their own skills. With wealth managers competing for talent, they must put value on the table.

Mora said the ability of advisors to get coaching advice and support at a firm is a big reason why they will join such an organization in the first place.

“Firms such as ours will continue to invest aggressively in its ability to support advisors, such as via human capital support, coaching and technology,” Mora said. Firms that make such investments will outperform those that do not.

AI has also put talent management in perspective, because this traditionally white-collar profession grapples with envisioning how new tech might enhance productivity and achieve other benefits . Then there is the regular concern about where the next generation of advisors will come from.

An Ameriprise survey of advisors in February 2025 said that skill enhancement and mentorship are a top priority. Six in 10 of advisors plan to attend industry conferences, half will take corporate development training, and more than a third will earn a new designation. Another third will work with a coach or mentor, an 11-percentage point increase from 2023.

Earlier, the advisor’s role was largely about sales, but this has changed, Mora said. “It is now understood that it is about education and having consultative skills…clients are more sophisticated.”

“About 500 people join this firm who have not been in the industry before. Many of the people entering the field are from colleges and universities, and these places have expanded their focuses and curriculum,” he said.

Mora has been at Ameriprise since 2001 – abundant time to get a sense of perspective around excitements/worries about new trends and to understand underlying issues in this sector. He concentrates on areas such as wirehouses, banks and independents. He does not deal much with RIAs; Mora is in a team that spans several hundred people, with 20 in recruitment roles.

A great sector to work in

FWR asked Mora if today’s wealth management industry might struggle to attract young talent if rival, supposedly more alluring sectors, seem more appealing.

“Advisors can be well compensated for their expertise and the responsibilities that they have. I certainly don’t see people leaving the industry because they cannot earn a living from what they do,” he said.

Even people who have no direct financial services experience can succeed as advisors if they have transferable skills. What’s needed are qualities such as being a good listener and communicator, Mora said.

Competition

This isn’t an easy sector to thrive in.

“While we have plenty of success in recruiting, hiring and training financial advisors, the barriers to entry and integration are still higher than some other professions given the hurdles of getting licensed and building a practice when client expectations are higher than ever and competition is also higher than ever,” Mora said.

So what is Ameriprise doing to counter the trend of an aging advisor industry?

Mora said his own firm has invested “heavily” in succession planning; building “teaming capabilities” so that advisors can identify, hire, train and integrate NextGen advisors, as well as interviewing, hiring and training hundreds of novice advisors. It’s the field leaders that have close links to local colleges and universities, especially those that offer the CFP program through their university and business school.

Marketing and business development

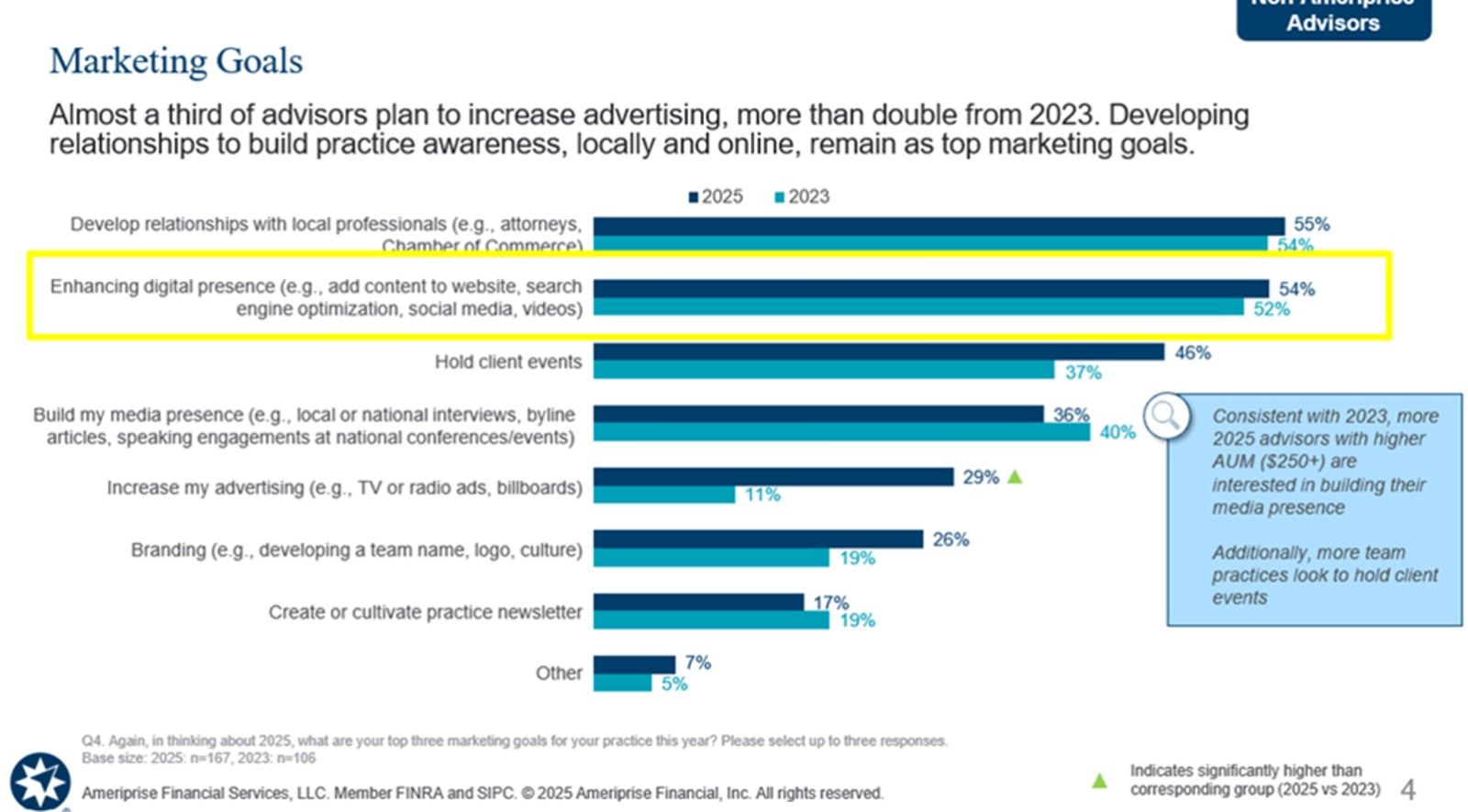

The Ameriprise survey showed that more than half of advisors polled sought to invest more in marketing, including working on their existing marketing footprint. They’re focusing on digital and local marketing goals such as developing client referral relationships with local professionals , enhancing their digital presence and increasing advertising efforts – more than double that of 2023.

Source: Ameriprise

Marketing, business development

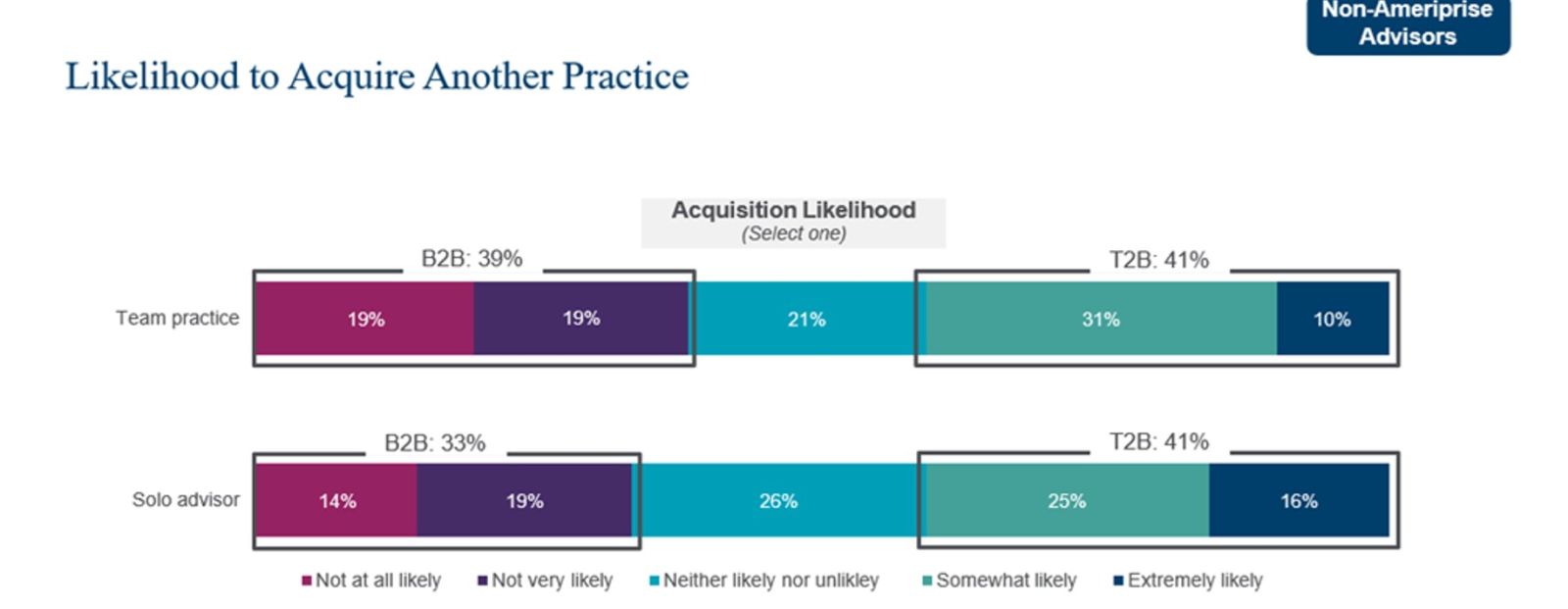

Four in 10 advisors are likely to acquire another firm in 2025, regardless of practice type . Advisors with a higher AuM or with less than 21 years of experience are more likely to make an acquisition.

Source: Amerprise

FWR concluded by asking Mora to reflect on the past 25 years he has been with Ameriprise – what has changed and what has remained constant.

“What has remained unchanged for my entire 24-year career is that pursuing a wealth management career as a financial advisor is still fundamentally about helping people feel secure about their financial future, make good decisions and achieve their financial dreams. A very noble way to make a living, in my view,” he said.